Grant and Funding Opportunities for Small Businesses

Starting and maintaining a small business can be an exhilarating journey filled with numerous challenges, one of the most significant being securing the necessary funding. Fortunately, various grants and funding opportunities are available for small business owners in the United States. This article aims to provide an up-to-date, comprehensive guide on grants, loans, and other funding sources, serving as a valuable resource for entrepreneurs looking to sustain and grow their businesses.

Understanding the Importance of Funding for Small Businesses

Small businesses are the backbone of the U.S. economy, driving innovation, creating jobs, and fostering community development. However, many small businesses face financial hurdles that can hinder their growth and sustainability. Access to funding is crucial as it enables businesses to invest in infrastructure, hire employees, market their products or services, and navigate through economic uncertainties.

Table Of Content

Types of Funding Opportunities

Grants

Grants are a form of financial assistance provided by government agencies, private corporations, and non-profit organizations. Unlike loans, grants do not need to be repaid, making them an attractive option for small businesses. However, obtaining a grant is highly competitive and requires meeting specific criteria and demonstrating how the funds will be used effectively.

Loans

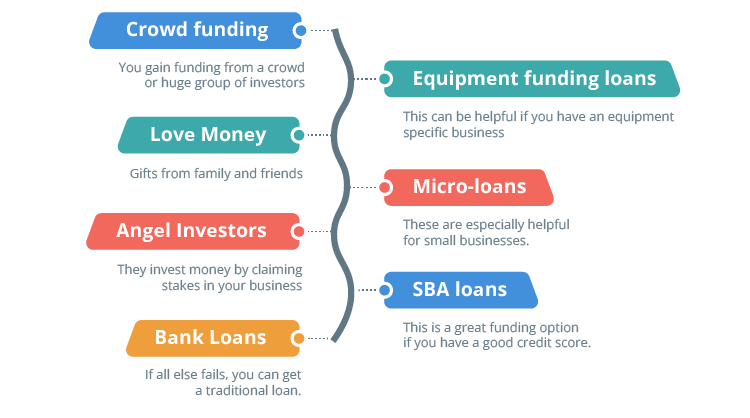

Loans are borrowed funds that businesses must repay over time with interest. Various types of loans are available, each with different terms, interest rates, and qualification requirements. Loans provide immediate capital but require a solid repayment plan.

Other Funding Sources

In addition to grants and loans, other funding sources include venture capital, angel investors, crowdfunding, and business competitions. These sources can provide significant capital but often involve giving up a portion of ownership or adhering to specific terms.

Government Grants and Funding Programs

The U.S. government offers several grants and funding programs specifically designed to support small businesses. Here are some key programs:

Small Business Innovation Research (SBIR) Program

The SBIR program encourages small businesses to engage in federal research and development with the potential for commercialization. This highly competitive program provides funding in phases, with initial grants for feasibility studies followed by larger grants for development and commercialization.

Small Business Technology Transfer (STTR) Program

Similar to the SBIR, the STTR program focuses on funding collaborative research projects between small businesses and research institutions. The aim is to facilitate the transfer of technology and innovative solutions from research labs to the market.

Grants.gov

Grants.gov is the central portal for finding and applying for federal grants. Small business owners can search for grants by category, eligibility, and agency. This platform simplifies the process of locating and applying for federal funding opportunities.

Economic Injury Disaster Loans (EIDL)

The EIDL program provides low-interest loans to businesses affected by declared disasters, including natural disasters and economic downturns. These loans help businesses cover operating expenses and recover from financial setbacks.

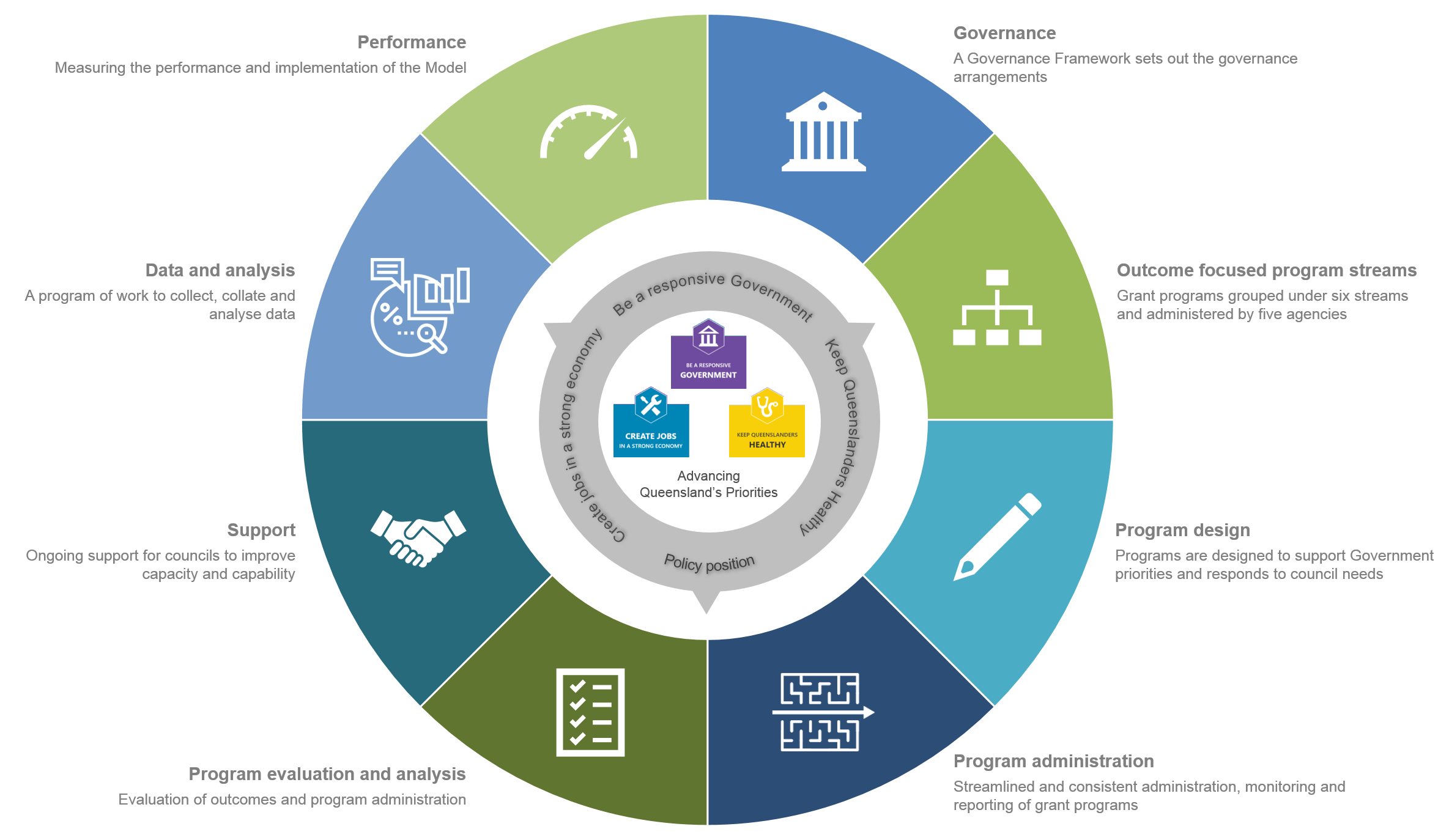

State and Local Government Grants

In addition to federal programs, many state and local governments offer grants and funding opportunities tailored to the needs of small businesses within their jurisdictions. These programs often focus on specific industries, underserved communities, or economic development goals.

State Small Business Credit Initiative (SSBCI)

The SSBCI provides funding to states to support small business lending and investment programs. Each state has its own programs and eligibility criteria, but the goal is to increase access to capital for small businesses.

Local Economic Development Agencies

Many cities and counties have economic development agencies that offer grants, low-interest loans, and other incentives to attract and retain small businesses. These programs often focus on job creation, innovation, and community revitalization.

Private and Non-Profit Grants

Private corporations and non-profit organizations also provide grants to small businesses. These grants can be industry-specific or aimed at supporting minority-owned, women-owned, or veteran-owned businesses.

FedEx Small Business Grant Contest

FedEx offers an annual grant contest that awards significant funding to small businesses based on criteria such as innovation, product quality, and community impact. Winners receive cash grants and business services.

National Association for the Self-Employed (NASE) Growth Grants

NASE offers growth grants to its members to support business expansion, marketing, and other operational needs. These grants are designed to help self-employed individuals and small business owners achieve their growth objectives.

Loans and Other Funding Options

Small Business Administration (SBA) Loans

The SBA provides a range of loan programs to support small businesses, including:

- 7(a) Loan Program: Offers loans for various business purposes, including working capital, equipment purchase, and real estate acquisition.

- 504 Loan Program: Provides long-term, fixed-rate financing for major fixed assets such as real estate and equipment.

- Microloan Program: Offers small, short-term loans for working capital or inventory.

Traditional Bank Loans

Traditional banks offer various loan products for small businesses, including term loans, lines of credit, and equipment financing. These loans often require good credit scores and collateral but can provide substantial funding.

Online Lenders

Online lenders have emerged as a popular alternative to traditional banks, offering faster approval processes and more flexible terms. Examples include Kabbage, OnDeck, and LendingClub, which provide short-term loans, lines of credit, and other financing options.

Venture Capital and Angel Investors

Venture capital firms and angel investors provide equity financing to high-potential small businesses, particularly in technology and innovative sectors. While these investors offer substantial capital, they often require equity stakes and involvement in business decisions.

Crowdfunding

Crowdfunding platforms like Kickstarter, Indiegogo, and GoFundMe allow businesses to raise funds from a large number of contributors. This method is particularly effective for new product launches and creative projects, as it provides both funding and market validation.

Tips for Securing Funding

Securing funding can be challenging, but following these tips can improve your chances of success:

- Research Thoroughly: Understand the requirements and eligibility criteria for each funding opportunity. Tailor your applications to meet these specific criteria.

- Prepare a Strong Business Plan: A detailed and well-thought-out business plan demonstrates your business's potential and helps convince funders of your viability.

- Highlight Your Unique Value Proposition: Clearly articulate what sets your business apart and why it deserves funding. Highlight innovation, market potential, and community impact.

- Build Relationships: Network with potential funders, attend industry events, and seek mentorship. Building relationships can open doors to funding opportunities.

- Stay Persistent: Rejection is part of the process. Learn from feedback, refine your approach, and continue applying to various funding sources.

Conclusion

Navigating the world of grants and funding opportunities can be daunting, but it's a crucial step for small business owners looking to secure the capital needed for growth and sustainability. By understanding the various funding options available and preparing strong applications, small businesses can access the financial resources they need to thrive. This comprehensive guide provides a valuable starting point for entrepreneurs seeking funding, highlighting key programs, tips, and strategies to succeed.

Additional Resources

For further information and assistance, consider exploring the following resources:

- SBA.gov: The official website of the Small Business Administration, offering resources, guides, and loan program information.

- Grants.gov: The central portal for federal grant applications and information.

- SCORE.org: A non-profit organization providing free business mentoring and educational resources.

- Local Small Business Development Centers (SBDCs): Offer free consulting and training to small business owners across the U.S.

By leveraging these resources and staying informed about new funding opportunities, small business owners can continue to drive innovation and economic growth in their communities.